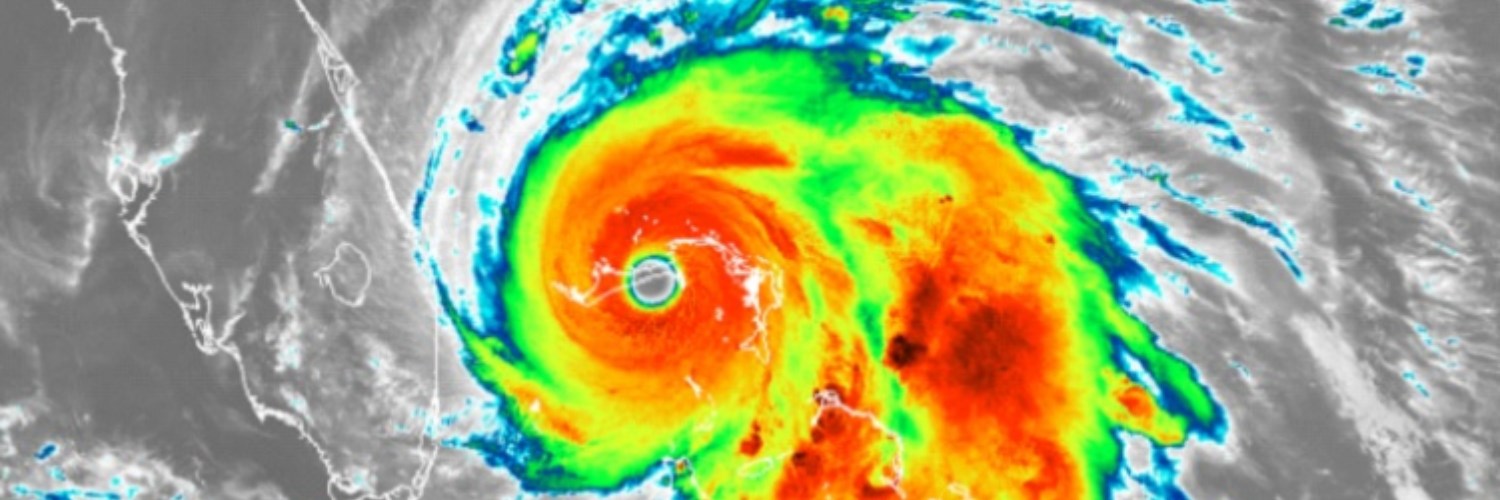

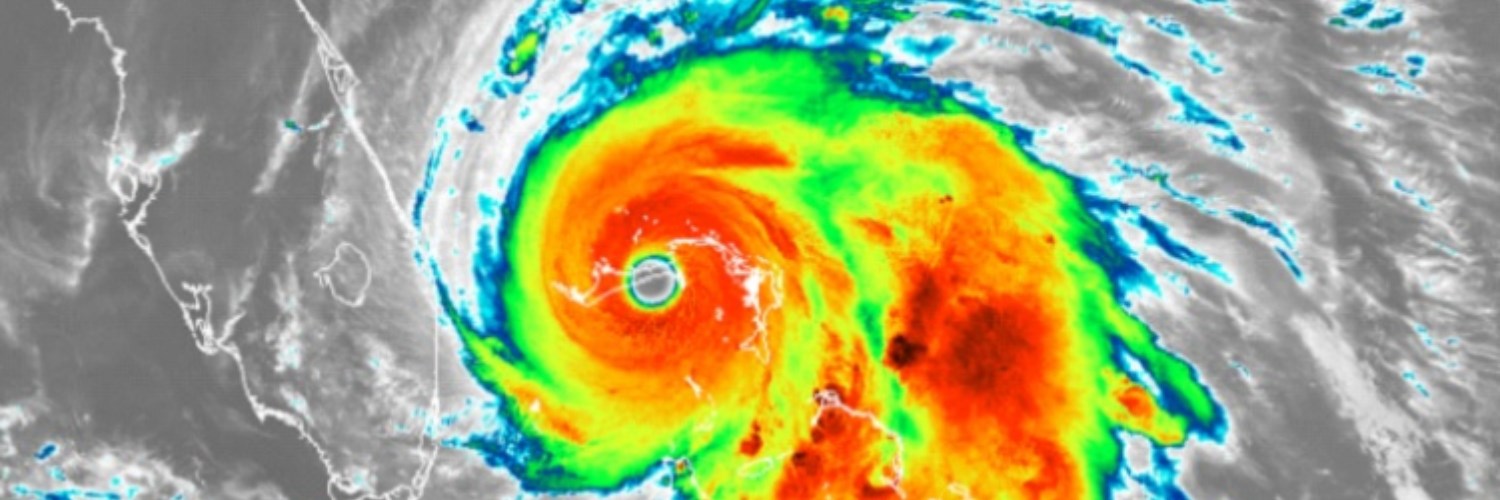

With international travel being restricted due to COVID-19 this fall, many U.S. travelers are looking to take a vacation in the Gulf Coast, East Coast, and the Caribbean. Travelers to these destinations need to be aware that this period is hurricane season in the Atlantic. This year’s hurricane season is shaping up to be the most volatile on record. As reported by Suzanne Rowan Kelleher in her recent Forbes article, only halfway through hurricane season and the National Oceanic and Atmospheric Administration (NOAA) has up its prediction to 19 to 25 named storms, including seven to 11 hurricanes. NOAA’s original official forecast for 2020 was for 13-19 named tropical storms and three to six hurricanes.

What does this mean for travelers? Travelers have to take proactive measures to protect their travel plans. The best way to do this is to purchase travel insurance. The question now is, what kind of travel insurance should they buy? The best types of insurance to purchase during hurricane season is Trip Cancellation, Trip Interruption, and Travel Delay Coverage.

Trip Cancellation provides reimbursement for unused, non-refundable, pre-paid trip costs if you are prevented from taking your trip due to certain unforeseen events that prevent you from traveling, such as a hurricane. For example, you are scheduled to travel to the Caribbean and a hurricane occurs. If you purchased Trip Cancellation insurance, you would receive a refund since you were not able to go on your vacation. Below are some factors that can cause your trip cancellation policy to be activated:

- Weather at departure site that causes a carrier delay of 12 hours or more

- Natural disaster at the destination that renders your accommodations uninhabitable

- Mandatory evacuation at Your trip destination due to hurricane or other natural disasters

- Home is made uninhabitable by a hurricane or natural disaster

- Interruption of water, electric, sewage, or gas service(s) at Your destination, for more than six hours due to inclement weather or natural disaster

- Accommodations at destination made inaccessible by original mode of transportation due to hurricane or other natural disasters

- A closed roadway to or from your trip destination

- Arrival at trip delayed due to a hazard (including weather) that causes you to lose 50% or more of trip duration

- Cancellation of sporting competition due to weather which you traveled more than 100 miles from home to attend

Once you depart for your vacation, you are eligible for trip interruption coverage. Trip interruption provides reimbursement for unused land and water activities along with additional transportation costs used to return home or rejoin your trip if a hurricane were to occur. Travel delay will provide reimbursement for hotel accommodation, meals, telephone calls, and local transportation while delayed.

Travelers should be aware that Trip Interruption and Travel Delay coverage complement each other.

This is because if you’re delayed and stuck somewhere, chances are you are also missing a portion of your trip. Trip Interruption can provide benefits for unused travel arrangements and Travel Delay can provide coverage for additional out-of-pocket expenses incurred during the delay.

With the proper coverage, travelers now have peace of mind and protection when they are embarking on travel this fall in the Atlantic region. To obtain a Trip Cancellation quote and purchase this product, please visit the Trawick International Trip Cancellation product page.

By

Administrator at 21 Sep 2020

The Future for the Travel Industry is Bright

A recent survey shows that 75% of American’s that took part in the study said they would keep traveling in 2020. This is a very positive note, especially when compared to the doom and gloom that the travel industry is currently facing. The data is taken from a ‘Travel Sentiment Monitor’ created by luggage storage provider, LuggageHero, who have an ongoing study to keep track of what Americans are feeling about traveling in general.

The results have many other interesting insights including the fact that many people that are going to keep their travel plans intact will do so if their departure and destinations do not have any quarantines. This makes a lot of sense from the passenger’s perspective because quarantines will have associated travel restrictions which will naturally make traveling hard. The report also shows that some people will keep traveling but may change their destinations to avoid risk. For example, 40% of Americans said they would replace international travel with domestic travel. This points to the fact that travelers are overall willing to travel but are being cautious.

Vigilance is further highlighted by how travelers are updating their budgets to suit the risks associated with travel due to the Coronavirus. Only 35% of the people that participated in the survey said they would keep their budget the same. The rest will adjust their travel expenses down to reduce costs and associated expenses.

The LuggageHero report is a great look at what to expect from the future of the travel industry. Most people are willing to travel as long as they have the proper precautions in place. This is something that is not lost on the travel providers who are already adapting to the new norm and updating their services to address customer needs. For example, airlines are giving passengers on planes enough space between seating to help keep their customers compliant with social distancing rules. Hotels are looking at ways to increase hygiene and cleaning services so that guests feel safe. Travel insurance providers are offering upgrades on policies that cover risks associated with the Coronavirus and others like Trawick International are including coverage for COVID-19 in their policies. To learn more about how Trawick International is covering the Coronavirus, visit our COVID-19 FAQ page.

Travel will return to normal, but it will not be the same. Passengers will expect providers to accommodate concerns about COVID-19 while they themselves will take the necessary precautions. This will range from using face masks to buying ‘pandemic’ friendly travel insurance. Some analysts predict that travel insurance purchases will increase because travelers can see the benefit of coverage in a time that has high risks associated with travel. Others even claim that a lot of people that have been given vouchers instead of refunds on airline tickets will cause a rush to utilize those tickets once things get back to normal.

If you are planning a trip in the upcoming few months, get in touch with our expert customer support team to get details on what type of travel insurance will serve your needs here.

By

Administrator at 17 May 2020

Every country in the world has their own sets of laws and policies that govern how residents pay for medical care. Some have socialized care which is provided by the government or privatized care where the patient pays for the care out of their own pocket or through insurance.

So, what happens if you are visiting a country and need medical attention?

In most cases even if the country has free healthcare for its own citizens, a foreign visitor will have to pay for their own bills. This is one of the leading reasons that vacationers purchase travel insurance. They want to avoid the bills and costs associated with an unexpected medical expense abroad.

Medical Expense Coverage

When planning a vacation, tourists always think of the great time they are going to have. Whether that includes lounging at the pool, getting a tan on the beach or enjoying a drink at a trendy bar, most dream vacations do not include illness or injury. However, it is a risk we all take when we leave our homes. This risk is most amplified when we are in unfamiliar locations or taking part in activities that can lead to getting hurt. Since we have no control over accidents or illness, it is best to be prepared.

Medical expenses coverage is there to pay for emergency treatment in case you fall sick or get hurt on holiday. Depending on the type of cover you have purchased, the following protections are included:

- Emergency Treatment and Medical Expenses

- Travel and Accommodation Costs

- Search and Rescue Costs

- Hospital Expenses

- Travel and Accommodation of Companion (Someone to stay with you while In the Hospital)

Exceptions for Medical Coverage

It is important to read the wording of your policy carefully before departing on your trip. This makes sure that you know exactly what is covered in case of an issue during your holiday.

A common thing that vacationers overlook is that some travel insurance does not offer benefits if you are found to be under the influence of alcohol when injured. Most people will probably have a glass of wine or some scotch if they are on vacation, so it is something to be aware of when traveling. Some policies also do not cover accidents that happen if the insured is under the influence of recreational or illegal drugs.

Some Activities Might Not Be Covered

Some other points to keep in mind is that travel insurance policies also have language that points out that injuries sustained because of violent activities or behavior will not be covered. Insurance providers also have restrictions on what type of activities they cover during your vacation. So normal sightseeing and tours may be covered but you could be denied medical expenses if you injure yourself in a high-risk activity like mountain climbing. Always check the language in your policy about what type of activities are covered. You may need to upgrade your policy if you plan on going for example on a ski trip instead of a regular visit to a city like Paris.

Medical expenses are standard for most travel insurance policies. What you need to keep in mind is that the coverage level and other restrictions vary. The best way to avoid being blindsided by a refusal from the insurance company for a medical expense is to go over all the details before making a purchase.

Emergency & Necessary Treatment

Travel insurance policies cover emergency or necessary treatments that are needed in the case of an illness or injury. Basically, this means that any medical procedure that is required to treat you after getting hurt or sick is covered. Emergency treatments are where you need immediate medical attention. Necessary treatments are ones that are needed and cannot be delayed or averted. However, anything beyond that is not covered. For example, cosmetic procedures or a regular medical checkup will not fall under this cover (with the exception of our wellness checkup benefit.)

Medical Repatriation

Medical repatriation is the act of bringing the insured back to their country of origin because of an illness or injury that cuts their trip short. Many travel insurance policies have medical repatriation as part of medical expenses cover. In some cases, repatriation can become quite expensive especially if they require new tickets or travel plans that need to be arranged in a short period of time. Special chartered flights with the proper medical facilities may be needed to transport a patient. These special flights are called air ambulances and you should check the language in your insurance to confirm that they are included as part of repatriation. However, these sorts of travel arrangements may not always be approved by the travel insurance company. If the movement of the patient is deemed harmful, alternative solutions may be provided. This is usually decided on a case-by-case basis so you should keep in mind that an air ambulance is not always the best solution.

Travel Insurance medical expenses may also cover a few other items like the cost of tickets and accommodation that must be forgone because the policyholder had to leave early. Another aspect of this is when a tourist receives treatment and is not fit to travel. They may need a few days or weeks to recover before they can depart for their home country. Travel insurance also covers these expenses and you should always speak with your provider about these points before purchasing a plan.

Pre-existing Medical Conditions

Some travelers may have existing medical conditions that can be a problem or may make their travel riskier when compared to a healthy individual. It is best to speak with your insurance provider and tell them about your pre-existing condition so that they can help you get the right coverage. If you do not do this, it is likely that any medical emergencies that may arise during your travel because of your condition will not be covered by travel insurance.

Steps to Take During a Medical Emergency

Even though insurance providers try to be as customer-friendly as possible, you cannot just call up the company and expect benefits. In case of an emergency, you must follow certain steps to ensure that you get reimbursements and the coverage that you are entitled to under your policy. There can be variation between travel insurance so always read your policy documents, so you know the procedures for your specific plan. If you are not sure what to do, you can always contact the sales or support team and ask them directly before you travel so that you are prepared.

If you are on vacation and are faced with a medical emergency, then follow the below steps and you should have all your bases covered:

- Immediately call the hotline for your travel insurance provider. Normally there should be a customer support person that can help you through a medical emergency. Make sure you keep the contact number and contact method readily available at all times while traveling. If you are unable to do it yourself have a relative or travel companion do it for you.

- Always keep cash or credit card on hand to pay for certain expenses on the fly. Sometimes you cannot wait or delay while waiting for the insurance company. In other cases, it is not possible for the medical staff to take payment from the insurance. So, it’s best to make these smaller payments yourself and then get reimbursed by insurance later.

- Depending on where you are vacationing, the hospital may not offer any medical assistance unless they are assured that you can pay for the bills. You should relay this information to the travel insurance hotline so they can guide you on how to give the hospital staff this confirmation.

- The bulk of your treatment and medical bills will be covered by insurance. The hotline will arrange for guarantees to present to the hospital or clinic.

- Always document everything. This includes itemized bills, doctors’ notes, lab reports, and receipts for medicine and other medically necessary items. The more proofs you have the better it is when filing claims. The travel insurance provider will require all this information when you reach back home.

Need Quality Travel Insurance?

By

Administrator at 6 May 2020

The travel industry is in an incredible amount of turmoil as the coronavirus epidemic sweeps across the globe. Airlines have been hard hit as passengers cancel their tickets or reschedule dates. Carriers have also been forced to shut down routes to countries and cities that have high rates of infections. All this has caused air traffic to drop significantly both internationally and domestically. As expected, this drastic drop in paying customers has hit the bottom line of airlines. They have scrambled to preserve cash and keep their doors open.

The risks of unannounced travel restrictions or canceled flights are also a major issue for travelers who have planned trips in advance and have made financial investments in tickets and other travel arrangements. Smart travelers have invested in travel insurance, but many have not and are left to reply on the airlines refund and exchange policies.

In the US, the government is looking at aid packages to keep airlines from buckling under the losses. The airlines themselves have taken drastic measures like furloughing employees and grounding older planes to replace them with newer, more efficient aircraft. Even these deep cuts do not seem to be enough to stem losses. One tactic that airlines have started to utilize is issuing vouchers for people whose flights have been canceled due to the Coronavirus. What this means is that instead of giving the passenger a refund of the ticket amount, they give them a voucher that can be used for a future flight. This practice is coming into favor because it helps the airline keep cash in their business and ensures that the passenger will fly with them in the future and not a competitor.

This practice may seem like a good idea to keep the financial outlook of the airlines positive, but it is against the rules. It has gotten so out of hand that the DOT has issued statements letting customers know they are due refunds. The EU has also made sure similar rules are in place to protect consumers. With governments stepping in to make sure refunds are issued, airline industry organizations are pushing back and want these rules to be relaxed or completely removed from the books. Industry advocates argue that airlines just cannot afford to offer everyone a refund at this time and need to issue vouchers instead.

With so much uncertainty on the horizon, passengers who are currently traveling or have plans to travel soon are stuck in a predicament. They cannot rely on the airlines to issue refunds. The only way to protect their investment in tickets and other travel costs is to purchase travel insurance that covers all the risks associated with the current travel situations. A good plan that offers insurance for trip cancellations and medical expenses for infectious disease are great policies that will give you pieces of mind that you will not be left in the cold. Some travel insurance companies are also issuing vouchers much like the airlines. It’s better than nothing but in these difficult times, most people need their liquidity. Our carriers, Nationwide and Gbg, are offering full cash refunds up until two days before your departure date should your plans have changed for any reason. This makes it a great choice for people considering coverage for their travel plans in these times of coronavirus.

If you would like to learn more about your options, please speak to an expert customer support agent here.

By

Administrator at 15 Apr 2020

Why You Should Buy Cruise Insurance from a Travel Insurance Provider

The cruise industry has evolved vastly over the last decade and now caters to a wide variety of passengers and demographics. Gone are the days of cruise ships full of retirees making their way into warm tropical islands. Today you can book a cruise that can take you from the North pole to the south with a wide range of people from all age groups. Activities onboard ships can be almost overwhelming and include bars, swimming pools, dining and so much more. Passengers have had to face cancellations or rescheduling because of mechanical issues with ships, bad weather, or, as we see in the news today, disease and epidemics. Most travelers understand the risks and make the prudent decision of purchasing cruise insurance to protect their investment. Cruise operators have seized on the behavior of the passengers have started to offer trip coverage. Cruise operators have made the process of buying insurance convenient and easy when you buy a ticket. This is the path of least resistance for most people but is it the best choice?

What Travel Insurance Providers Offer

When buying travel insurance from a cruise company, you have one choice of plan to purchase. This means that the passenger has no choice but what the cruise operator is offering if they buy through their website. However, with an independent travel insurance provider, you have an incredible number of choices and plans to select from. You can check providers' reputations, the benefits they provide and obtain a customized travel insurance plan that suits your needs.

Trip Cancellation

Trip cancellation travel insurance offers reimbursements if you cancel your trip for a set of predefined reasons. For example, if someone gets sick or death occurs, your trip cancellation insurance will provide reimbursement. Insurance offered by the Cruise operator will, in most cases, have fewer reasons when compared to travel insurance provided by a travel insurance provider. This means that travel insurance purchased from a travel insurance provider will offer you more protection when compared to cruise insurance policies.

Coverage

Trip insurance bought through a cruise line will, in many cases, only cover the tickets and travel arrangements purchased through the cruise operator. If you have airline tickets you bought to arrive at the cruise departure point, that will not be covered. Travel insurance from a travel insurance provider allows you to cover all travel associated with your trip in one policy. Once again, this gives you better coverage against exposure to risks.

Higher Compensation & Lower Costs

Cruise lines are experts at running their businesses. Travel insurance is not their main focus and is most often being offered through a third party. It may be convenient to purchase them with just one click, but the associated expense may be higher. Travel insurance providers can offer better deals and rates when compared to cruise insurance. They can also provide higher compensation and benefits. This means if you would like more coverage for your luggage, you can get it instead of cruise lines that will have lower limits.

Government Regulations

Travel insurance plans are under the State Department of Insurance and must abide by the rules and regulations in place for that state. This gives an added layer of security for people purchasing from a travel insurance provider. The rights of the consumer and the insurance company are protected through these regulations making transactions and reimbursements easier and fair.

It boils down to that it may be slightly more convenient to purchase insurance from a Cruise operator, but if you spend a little more time buying a plan from a travel insurance provider, you can get a lot more. This includes better pricing, better coverage, more options, and the knowledge that you are buying insurance from experts in travel coverage.

Looking for the right type of cruise insurance?

By

Administrator at 4 Apr 2020