Spend Your Money Wisely. Learn Why You Should Purchase Travel Insurance Directly From a Travel Insurance Provider.

Travelers today are looking to protect their vacation with travel insurance more than years passed. A recent survey conducted by the US Travel Insurance Association (UStiA), found that before 9/11, only 10% of leisure travelers purchased travel insurance, while today, more than 30% of leisure travelers buy it. When asked why, the top three reasons are: peace of mind, protection against the unexpected, and concern over losing the financial investment in a trip.

In the COVID-19 world that we are living in today, many things are uncertain, especially for someone or a family looking to travel during these times. As noted in the UStiA survey, protection against the unexpected is a significant factor in why travel insurance is being purchased. Travelers have the option of buying insurance from the airlines or from a travel insurance provider.

The airlines make it simple and convenient to get insurance when purchasing flights. This seems like an added benefit; however, the customer must be aware that the convenience they are receiving by working with the airlines doesn't provide them with the best travel protection. Working with a travel insurance provider offers a variety of plans that will provide enhanced protection that the airline coverage does not match.

The below chart represents what a customer will get when they purchase Trawick International’s (a travel insurance provider) Safe Travels Voyager policy.

|

Coverages

|

Safe Travels Voyager

|

|

Trip Cancellation

|

Up to 100% of Trip Cost Insured

|

|

Trip Interruption

|

Up to 125% of Trip Cost Insured

|

|

Travel Delay

|

$750 ($150 per day) / 6 hours

|

|

Missed Connection

|

$750

|

|

Airline Ticket Exchange Fee

|

$100

|

|

Baggage Coverage

|

N/A

|

|

Baggage Delay Coverage

|

$2,000

|

|

Medical Coverage

|

$400 / 12 hours

|

|

Dental Coverage

|

$150,000

|

|

Emergency Evacuation and Repatriation

|

$750

|

|

Accidental Death & Dismemberment - Air Flight Accident

|

$500,000

|

|

Accidental Death & Dismemberment - 24 Hour

|

$25,000

|

|

Rental Car Damage

|

Optional

|

|

Pet Coverage

|

Optional

|

|

Financial Default

|

N/A

|

|

Pre-Existing Coverage

|

Included Within 14 Days of Deposit

|

|

Coverage Type

|

Included Within 14 Days of Deposit

|

Now compare that to Delta’s Deluxe Domestic Trip Protector II Policy (an airline’s travel insurance policy) below.

|

Coverages

|

Deluxe Domestic Trip Protector II

|

|

Trip Cancellation Coverage

|

Up to 100% of trip cost ($8,000 max.)

|

|

Trip Interruption Coverage

|

Up to 100% of trip cost ($8,000 max.)

|

|

Travel Delay Coverage

|

$300 (Daily max.:$150 with receipts; $75 without receipts) - Minimum Required Delay - 6 hours

|

|

Baggage Coverage

|

$750 ($500 High-Value Item max.)

|

|

Baggage Delay Coverage

|

$500 ($100 no receipts max.) - Minimum Required Delay - 24 hours

|

|

Concierge

|

Included

|

|

24 Hour Assistance

|

Included

|

|

Pre-existing Medical Condition Exclusion Waiver

|

Available

|

|

Coverage Type

|

Secondary

|

After comparing the two policies, one from Trawick International and Delta. You can see a significant difference between the policies in what they offer and the coverage that they provide. Working with a travel insurance provider, you receive higher reimbursement for baggage coverage and no max amount of coverage for trip cancellation coverage and trip interruption coverage.

When working with a travel insurance provider, the customer can obtain customized coverage for their entire trip where the airlines have a one size fits all. So what does that mean for the customer? This means the customer is stuck with a policy that the airlines have created for everyone with no flexibility to customize their coverage based on their individual needs.

The below chart shows the optional coverage a customer can purchase when working with Trawick International.

|

Additional

Coverage

|

Safe Travels Voyager

|

|

Trip Cancellation for Any Reason

|

N/A

|

|

Rental Car Damage

|

$35,000

|

|

Accidental Death & Dismemberment - Air Flight Accident

|

$100,000

|

|

Accidental Death & Dismemberment - 24 Hour

|

$25,000

|

|

Baggage & Personal Effects

|

Included

|

|

Pet Coverage

|

N/A

|

As noted in the chart above, the customer can customize the policy to meet their specific needs when traveling. These added features allow the customer to receive the best possible protection when traveling and mitigates against unforeseen circumstances.

With uncertainty becoming the norm, it’s crucial to have the best possible coverage. That is why you should purchase insurance with a travel insurance provider. Taking that extra step will allow you to have peace of mind when traveling. To obtain a Safe Travels Voyager quote and purchase this product, please visit the Trawick International Safe Travels Voyager product page or one of our independent representatives for a quote today.

By

Administrator at 12 Nov 2020

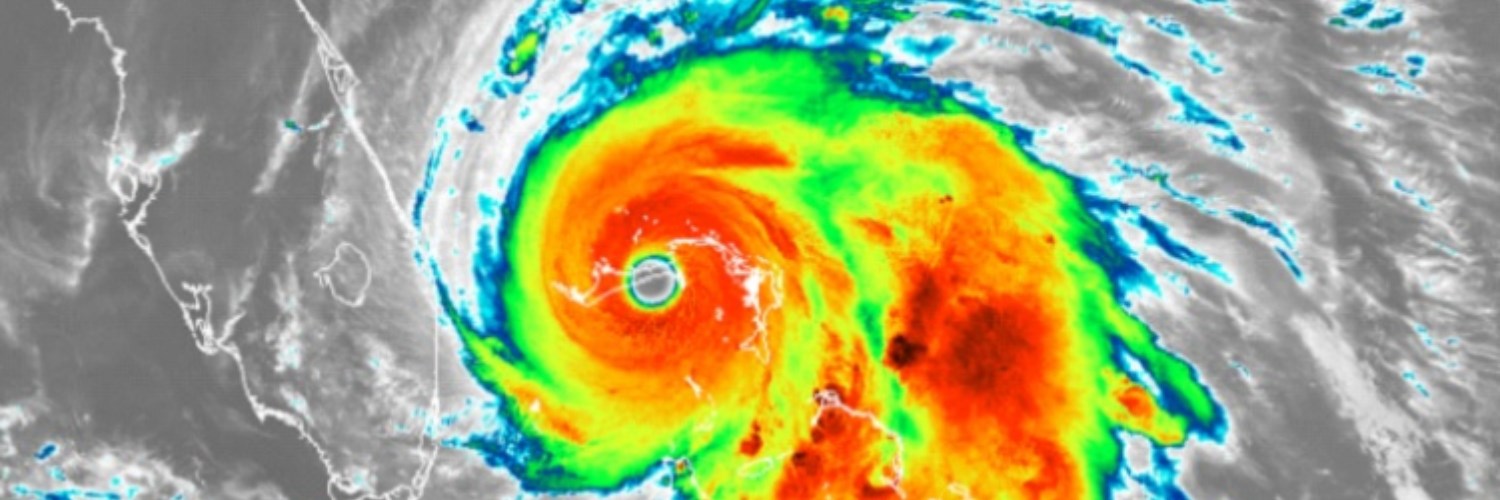

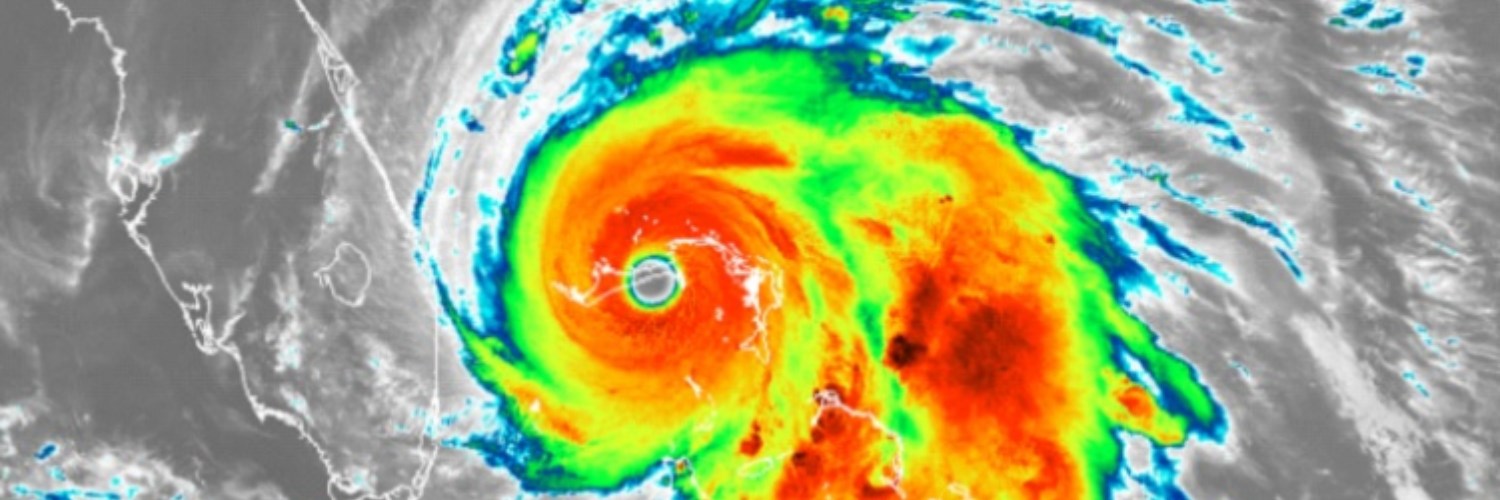

With international travel being restricted due to COVID-19 this fall, many U.S. travelers are looking to take a vacation in the Gulf Coast, East Coast, and the Caribbean. Travelers to these destinations need to be aware that this period is hurricane season in the Atlantic. This year’s hurricane season is shaping up to be the most volatile on record. As reported by Suzanne Rowan Kelleher in her recent Forbes article, only halfway through hurricane season and the National Oceanic and Atmospheric Administration (NOAA) has up its prediction to 19 to 25 named storms, including seven to 11 hurricanes. NOAA’s original official forecast for 2020 was for 13-19 named tropical storms and three to six hurricanes.

What does this mean for travelers? Travelers have to take proactive measures to protect their travel plans. The best way to do this is to purchase travel insurance. The question now is, what kind of travel insurance should they buy? The best types of insurance to purchase during hurricane season is Trip Cancellation, Trip Interruption, and Travel Delay Coverage.

Trip Cancellation provides reimbursement for unused, non-refundable, pre-paid trip costs if you are prevented from taking your trip due to certain unforeseen events that prevent you from traveling, such as a hurricane. For example, you are scheduled to travel to the Caribbean and a hurricane occurs. If you purchased Trip Cancellation insurance, you would receive a refund since you were not able to go on your vacation. Below are some factors that can cause your trip cancellation policy to be activated:

- Weather at departure site that causes a carrier delay of 12 hours or more

- Natural disaster at the destination that renders your accommodations uninhabitable

- Mandatory evacuation at Your trip destination due to hurricane or other natural disasters

- Home is made uninhabitable by a hurricane or natural disaster

- Interruption of water, electric, sewage, or gas service(s) at Your destination, for more than six hours due to inclement weather or natural disaster

- Accommodations at destination made inaccessible by original mode of transportation due to hurricane or other natural disasters

- A closed roadway to or from your trip destination

- Arrival at trip delayed due to a hazard (including weather) that causes you to lose 50% or more of trip duration

- Cancellation of sporting competition due to weather which you traveled more than 100 miles from home to attend

Once you depart for your vacation, you are eligible for trip interruption coverage. Trip interruption provides reimbursement for unused land and water activities along with additional transportation costs used to return home or rejoin your trip if a hurricane were to occur. Travel delay will provide reimbursement for hotel accommodation, meals, telephone calls, and local transportation while delayed.

Travelers should be aware that Trip Interruption and Travel Delay coverage complement each other.

This is because if you’re delayed and stuck somewhere, chances are you are also missing a portion of your trip. Trip Interruption can provide benefits for unused travel arrangements and Travel Delay can provide coverage for additional out-of-pocket expenses incurred during the delay.

With the proper coverage, travelers now have peace of mind and protection when they are embarking on travel this fall in the Atlantic region. To obtain a Trip Cancellation quote and purchase this product, please visit the Trawick International Trip Cancellation product page.

By

Administrator at 21 Sep 2020

Traditional Travel Insurance vs Airline Insurance

Buying airline tickets has become incredibly easy. Most people don’t even use travel agents anymore. They simply hop online, search using a flight aggregator, and select a flight that best fits their needs. In most cases, they pay for the ticket online through the airline website and receive an email with confirmation and a digital ticket. No human interaction whatsoever. Airlines have kept up to speed with the behaviors of their customers and are offering more and more options to travelers on their websites or through their apps. One such added value is the ability to purchase travel insurance right after your ticket.

For most people, this may seem like a great deal and a convenient solution. However, is the insurance the airline offers as good as traditional travel insurance? We explore the difference between the two in this post.

No Standardization

Airlines are not obligated to offer their passengers any sort of travel coverage. This is an extra service they offer as a convenience to their customers. There is no standard or baseline travel insurance on offer by all the airlines. Some carriers do not even offer travel insurance. While others use third parties to give coverage plans to people that are interested.

Varying Benefits

As mentioned above, airline travel plans can vary in many ways including benefits, costs, and types of coverage. For example, one carrier’s insurance may cover the entire cost of your trip while another may have a set limit of up to $1000. There can also be a difference in benefits, like travel medical coverage or lost baggage. Plans also come in many different price points, from the very cheap to fairly expensive. All this can once again make it hard to understand or compare plans.

Lack of Choice

A problematic part of buying airline insurance is that travelers have no choice. In most cases, an airline has an underwriter to their insurance and that is the only one a ticket holder can select. This means even if the insurance company is not your first choice, you are forced to go with them if you buy through the airline.

The lack of options does not stop with just the underwriter or third-party provider. Most airlines only have one plan that you can choose. A one solution fits all approach is used which can leave you exposed to risks that you would normally want to have covered. Since there is no customization of plans you may find that sometimes many of the activities you wish to participate in during your trip are not covered. One common example is if you are into adventure sports and take a trip on which you will be rock climbing, the airline insurance may not cover this type of high-risk activity.

Independent Travel Insurance Providers Offer True Choice

One of the great things about purchasing traditional travel insurance is that you have an actual choice. A traveler can easily shop around for price, benefit limits, and coverages. There is no restriction on who you purchase from and what type of coverage you get. When buying regular travel insurance, you can work with agents to find the plans that suit your needs and give you coverage where you need them. Whether that is higher reimbursement for baggage because you are carrying expensive camera equipment or better medical coverage because you are taking a trip to an area that has a high chance of disease. Traditional travel insurance gives you the ability to make choices that will reflect the risks you expect to face.

Expertise In Travel Insurance

Airlines are essentially middlemen for the insurance provider. This means that they are not the most knowledgeable about the coverage. When you deal with a travel insurance provider directly, you get the massive benefit of interacting with experts in the field who have firsthand knowledge. They can offer guidance and recommendations that will save you time, money, and headaches.

So the next time you need travel insurance, weigh the pros and cons of airline travel insurance and traditional travel insurance, and make an informed decision that is best for your circumstances.

Trawick International offers many plans that cover trip cancellation, lost baggage, travel medical, and more. These plans even cover COVID-19 like any other illness. To learn more about how our plans treat the coronavirus, visit our COVID-19 FAQ page. Click below to get a quote or to chat with a travel insurance expert to find the right travel insurance for your needs.

By

Administrator at 31 Mar 2020

Are you planning on doing any end of the year traveling? If so, one thing you may need to consider is what to do about your pet should you have plans of bringing him/her along. Thankfully, flying with your four-legged friend is easier than ever as the majority of airlines are quite animal friendly. However, each airline has regulations regarding pet rules so make sure you thoroughly research them prior to booking your trip.

Most airlines will allow you to bring along your pet as either checked or carry-on luggage. You may already have a pet carrier that you prefer to keep your fur baby in, but make sure that it is okay to use and that it meets the specific regulations, so you don’t run into any surprises when you show up at the airport. Guidelines will vary but, in most cases, pets traveling as carry-on luggage will be required to go underneath the seat for the duration of the flight in a soft carrier. Larger pets traveling as cargo will be required to fly in a non-collapsible carrier and they must have plenty of water available.

With the increase of travelers bringing along their pets, hotels are increasingly providing pet friendly options as well. Major chains like the Ritz-Carlton and Four Seasons will roll out the red carpet for your four-legged friend but again, make sure to read policies before booking your stay. You will also be required to pay an additional fee for your pet to stay with you.

Before you and your pet leave for your trip, take the time to prepare for unforeseen medical emergencies. Research any emergency vet clinics in or near your destination in case you find yourself having to take your pet to an animal doctor. Also, look into getting travel insurance for your pet! We can cover you AND your pet with our Safe Travels First Class policy.

Founded in 1998, Trawick International is a full service travel insurance provider specializing in protecting travelers of all types around the world. We offer a variety of travel insurance plans designed specifically by types of coverage, including comprehensive travel protection insurance, international travel medical insurance, visitor’s insurance, and international student insurance.

Our company mission is to deliver superior travel and medical insurance products which offer the best 24/7 emergency assistance services available. To become a Trawick International partner call 888-301-9289 or email info@trawickinternational.com.

By

Administrator at 4 Dec 2018