Travel Is On The Uptick So Make Sure You Have The Right Coverage When Traveling

The travel industry has been one of the hardest-hit sectors during the COVID-19 pandemic. Travel incurred a significant decline to its annual performance because of numerous domestic and international travel restrictions implemented during the spring to curb the spread of COVID-19 during the height of the pandemic. As reported by the Transportation Security Administration (TSA) on April 14, 2020, only 87,534 travelers passed through TSA security checkpoints. On April 14, 2019, over 2.2 million passed through them. That is over 2.1 million fewer travelers. April 14th of this year saw the fewest travelers during the pandemic.

Over the past few months, TSA has seen a significant increase in travel. TSA Reported on September 4, 2020, that over 968 thousand travelers went through security checkpoints and on September 7, 2020, over 935 thousand travelers checked in at TSA security. These two days marked the first time since the pandemic occurred that the TSA has seen over 900 thousand travelers. These two days were the Friday and Monday of Labor Day weekend. Looking at the TSA checkpoint travel numbers for 2020 and 2019 indicates that far fewer travelers are embarking on trips, which is the bad news, but over the last few months, more and more travelers have started to travel.

With travel restrictions being eased for domestic and international trips, we should see a continued rise in travelers willing to fly. Travel destinations have started to offer an increase in vacation offerings and less strict COVID-19 travel regulations. For example, the Dominican Republic announced that it would no longer require tourists to present a negative COVID-10 test to enter the country. Mexico has announced that they are reopening the Mayan ruins to tourists for the first time since the pandemic began and many states across the nation continue to lift travel restrictions on interstate travel.

For travelers wanting to go on a vacation this fall season, we at Trawick International want to make sure that they are fully protected to travel and have the best possible travel coverage. That is why we offer different types of plans that cover COVID-19. Our policies will treat COVID-19 as any other sickness for all illness-related losses.

As an example, in the event you, your traveling companion or a non-traveling family member were to become ill before your departure date, our plans would provide reimbursement for the prepaid, non-refundable trip costs. If, while traveling, you or your traveling companion becomes sick, our plans would reimburse for the lost days of your trip, along with medical expenses incurred during your trip. Additionally, our plans would provide coverage in the event of an emergency evacuation or if repatriation of remains was needed.

We highly recommend purchasing Cancel for Any Reason (CFAR) coverage. This benefit is available on our Safe Travels First Class and Safe Travels Voyager travel plans. With this benefit, you can cancel your trip for any reason and we will reimburse you up to 75% of your prepaid, non-refundable trip cost. Check out our COVID-19 FAQ Page for more information about how Trawick International travel insurance covers COVID-19.

By

Administrator at 30 Sep 2020

As we celebrate the High Holidays of Rosh Hashanah and Yom Kippur, many travelers from Israel are wondering if they are allowed to visit the United States. At this time, there is no restriction for non-United States travelers to enter the country or to obtain travel insurance. This is great news for citizens of Israel who have family in the United States and want to visit them and celebrate the High Holidays as a family.

With the ongoing pandemic occurring in the United States and globally, travelers need to take additional precautions to protect themselves and their families when traveling. One protection that travelers should consider is purchasing travel medical insurance. Why should a traveler from Israel need to obtain travel medical insurance? The government of the United States does not provide healthcare for visitors from outside of the United States. It is essential to get travel medical insurance if your policy doesn’t cover you while you’re abroad or if your policy limits your coverage during the pandemic.

With the ongoing COVID-19 pandemic, we at Trawick International offer several plans for Citizens/Residents of Israel to choose from that provide coverage for COVID-19 related expenses. We treat COVID-19 the same as any other illness. Trawick International is one of the few travel medical insurance providers that offer this type of coverage. For your added peace of mind, we also provide a visa letter that states COVID-19 is covered as well.

We, at Trawick International, recognize how valuable it is for all family members to get together during the High Holidays and to make sure travelers above the age of 65 are eligible for travel medical insurance.

We offer three policies for travelers from outside the United States. Our Safe Travels USA and Safe Travels USA Cost Saver insurance plans provide primary medical coverage, which will take care of your covered medical expenses, including hospitalization, surgery, physician visits and prescriptions. Both cover Unexpected Recurrence of a Pre-existing Condition up to $1000. The Safe Travels USA Comprehensive plan offers Up to $1,000,000 in medical coverage. This plan also has coverage for Acute Onset of a Pre-existing Condition up to the maximum for most ages and up to $35,000 ages 70 and over. All three plans offer up to $100,000 of medical expense coverage for ages 70- 79 and $50,000 up to age 89.

Visit Trawick International for more information about our Inbound to the USA Travel Medical Insurance or to obtain your Travel Medical Insurance Quote.

By

Administrator at 23 Sep 2020

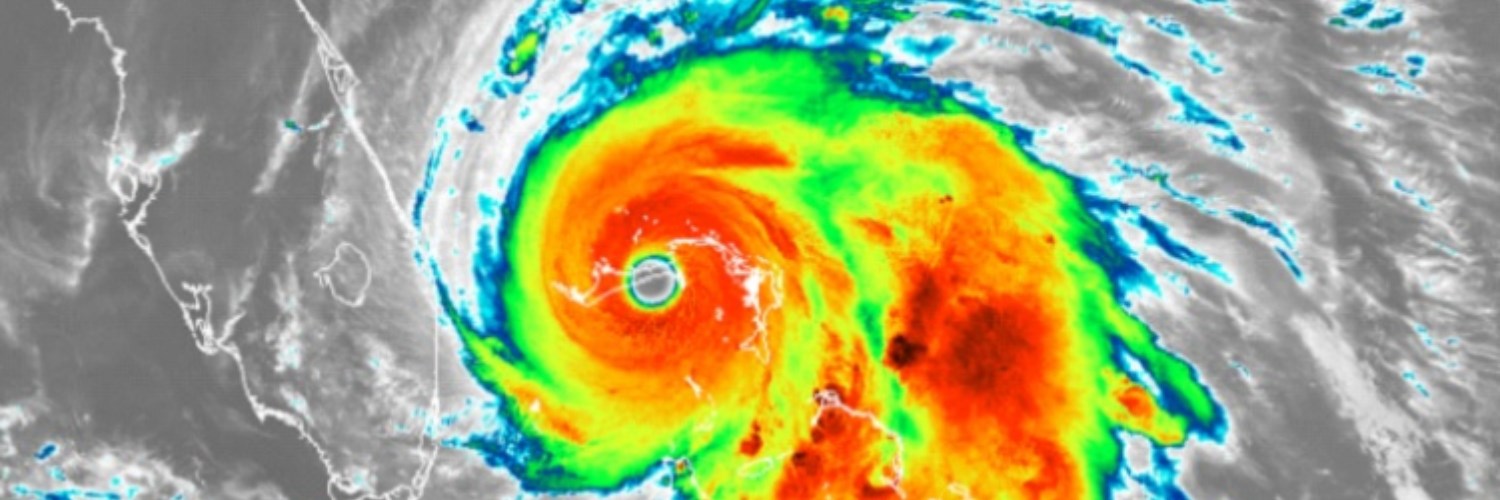

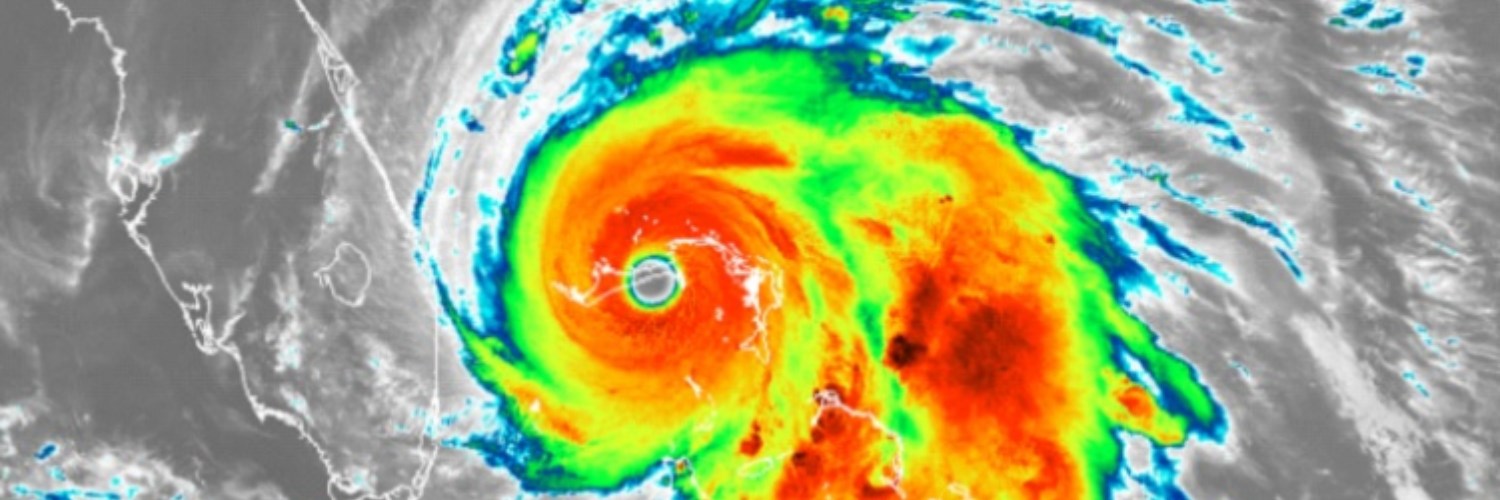

With international travel being restricted due to COVID-19 this fall, many U.S. travelers are looking to take a vacation in the Gulf Coast, East Coast, and the Caribbean. Travelers to these destinations need to be aware that this period is hurricane season in the Atlantic. This year’s hurricane season is shaping up to be the most volatile on record. As reported by Suzanne Rowan Kelleher in her recent Forbes article, only halfway through hurricane season and the National Oceanic and Atmospheric Administration (NOAA) has up its prediction to 19 to 25 named storms, including seven to 11 hurricanes. NOAA’s original official forecast for 2020 was for 13-19 named tropical storms and three to six hurricanes.

What does this mean for travelers? Travelers have to take proactive measures to protect their travel plans. The best way to do this is to purchase travel insurance. The question now is, what kind of travel insurance should they buy? The best types of insurance to purchase during hurricane season is Trip Cancellation, Trip Interruption, and Travel Delay Coverage.

Trip Cancellation provides reimbursement for unused, non-refundable, pre-paid trip costs if you are prevented from taking your trip due to certain unforeseen events that prevent you from traveling, such as a hurricane. For example, you are scheduled to travel to the Caribbean and a hurricane occurs. If you purchased Trip Cancellation insurance, you would receive a refund since you were not able to go on your vacation. Below are some factors that can cause your trip cancellation policy to be activated:

- Weather at departure site that causes a carrier delay of 12 hours or more

- Natural disaster at the destination that renders your accommodations uninhabitable

- Mandatory evacuation at Your trip destination due to hurricane or other natural disasters

- Home is made uninhabitable by a hurricane or natural disaster

- Interruption of water, electric, sewage, or gas service(s) at Your destination, for more than six hours due to inclement weather or natural disaster

- Accommodations at destination made inaccessible by original mode of transportation due to hurricane or other natural disasters

- A closed roadway to or from your trip destination

- Arrival at trip delayed due to a hazard (including weather) that causes you to lose 50% or more of trip duration

- Cancellation of sporting competition due to weather which you traveled more than 100 miles from home to attend

Once you depart for your vacation, you are eligible for trip interruption coverage. Trip interruption provides reimbursement for unused land and water activities along with additional transportation costs used to return home or rejoin your trip if a hurricane were to occur. Travel delay will provide reimbursement for hotel accommodation, meals, telephone calls, and local transportation while delayed.

Travelers should be aware that Trip Interruption and Travel Delay coverage complement each other.

This is because if you’re delayed and stuck somewhere, chances are you are also missing a portion of your trip. Trip Interruption can provide benefits for unused travel arrangements and Travel Delay can provide coverage for additional out-of-pocket expenses incurred during the delay.

With the proper coverage, travelers now have peace of mind and protection when they are embarking on travel this fall in the Atlantic region. To obtain a Trip Cancellation quote and purchase this product, please visit the Trawick International Trip Cancellation product page.

By

Administrator at 21 Sep 2020